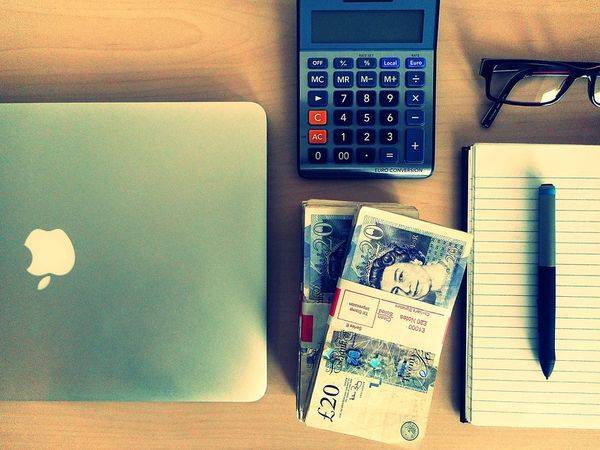

Business Finances. Image Source.

The business world is a tricky one – and an expensive one. If you start making mistakes, you could ruin both your business and your personal finances. So make sure you are clued in on business finance before you make any sudden moves!

Call in the experts

Dealing with business finances isn’t something you should do by yourself as the business owner. After all, you have a lot more work to be getting on. You should be focusing your efforts on these areas of your talents. If you have several employees, then this becomes even more important. You need to deal with incomes, taxes, retirement funds… It might be worth getting the help of wealth management experts. A company like B&K Consulting can help you find the right people.

Do some reading

You may have some experts to help you with finances but this does not mean that you should just sit around and let all of them do everything for you. What if they have a problem to report to you? What if you need to make some of those financial decisions based on their advice? You should not be going into this kind of thing blind. You should make it a point to teach yourself the intricacies of business finance. If you get time, you may even want to take a quick course in it.

Read business news. Image Source.

Know your limits

Will a particular deal violate any of your business’s ethics or even a state-sanctioned regulation? If you seek additional capital, how do you propose to make sure you do not have to do it again? Are you operating in the red, or in the black? When would you have to declare bankruptcy? How much money can you really afford to spend on recruitment or new equipment? Even if business is going really well and you have a steady stream of revenue, you need to know your limits because if you exceed them, it can spell disaster for your business. Know your business risk tolerance.

Tackle debt head-on

Business owners tend to find themselves in debt – this is not out of the ordinary. After all, most business owners have to borrow money to fund their venture! Make sure you are keeping on top of repayments. Do not put them off. One of the most common problems here is that business owners who get into debt tend to get into debt with several lenders. They need not be particularly large amounts in terms of borrowed funds but the fact is that having several debts makes the whole thing harder to keep track of. Consider consolidating your business debts.

Tackling debt. Image credit

Keep track of your customers

Collecting customer data is an incredible way of making sure you keep your finances in check. It is one of the best ways of understanding why you may not be selling enough of a particular item. Did customers who like that product stop coming to your business? Alternatively, were there people who were buying it who have stopped buying it despite still doing business with you? This can help you get a handle on any losses. Customer data is also vital if you have problems with customers not paying you on time. If someone keeps being tardy with payments, stop giving him or her chances!