Savings – for some, it is just something they wish. Others think that they will have it only if they have more income. Others do not care at all. Are you among the few who really strive to allocate a portion of their income to savings?

If you want to retire young, you really should prioritize on saving a portion of your income. My husband and I retired from the workforce at a young age. It took a lot of foresight and planning to achieve this dream but if you know how to save and live frugally, you have good chances of living a comfortable life, at the least.

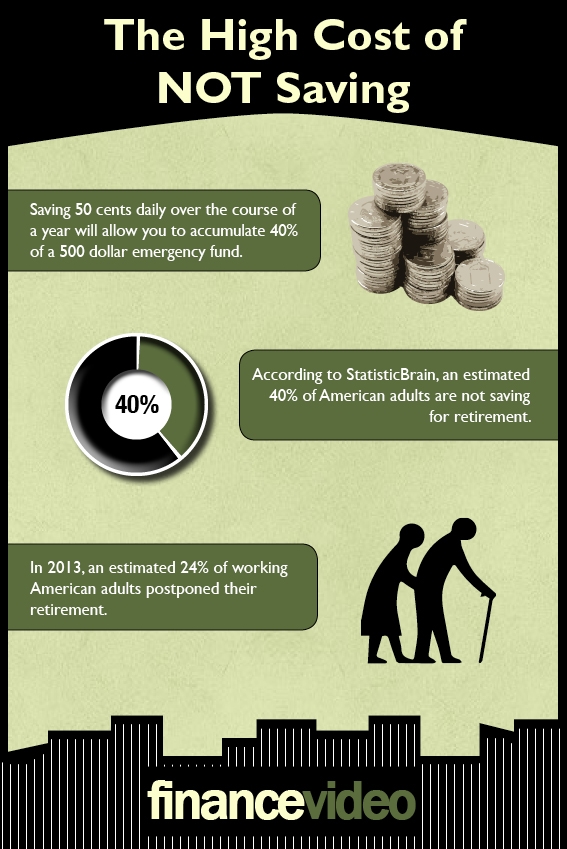

I could never stress enough the importance of saving. Our rule of thumb is to have a savings that will cover at least three months of expenses including, but not limited to, mortgage, car amortization, estimated utilities, food and other fixed expenses that you have. Aside from the emergency fund, you can use your excess saving to invest and earn passive income in that process.

If you do not save, the longer you need to work before you can retire. What makes it expensive too is the fact that you need to rely on loans (home loans, title loans, car loans and similar loans) and incur interest expenses if you do not have enough savings.

Anyway, do you agree with me that it is indeed more expensive not to save than to put something into your savings regularly? Care to share your thoughts?